Does the regulation state that it applies to cadets?

We’ve decided to give the places to another Sqn who can take their Cadets  our OC gave a definite no to our FS taking them, any ideas who we would need to contact should this situation arise again?

our OC gave a definite no to our FS taking them, any ideas who we would need to contact should this situation arise again?

Shame.

I would say he’s done this to avoid the puritans out there making all sorts of comments.

Np one ever really said what the rationale of business insurance was, it just came out a few years ago, in true Air Cadet /military style. They should pay part of the premium, like my employer does, as it saves 100s on hire cars, even with petrol at 45ppm.

To be honest the difference in my insurance last year was around £5, i only declare that i will be doing 2000 miles a year (which is more than enough for what i claim).

I spoke to them and they stated that they are quite happy that i am covered without business class insurance if i am not claiming as its a hobby so not a problem but i would need it for mileage claims, i got this backed up in an email.

If you’re a Sqn OC and you ask one of your staff or cadets to transport other cadets in their private motor car then you are asking them to do a job of work for the RAFAC.

The driver will need business use on their insurance. Simple.

Except, as already noted, when your insurer doesn’t consider volunteering for the ATC as work. Not so simple.

That’s fine. But I would suggest if it’s not clear on your policy document you get it in writing. Personally, if I were in a position of asking people to transport Air Cadets in their private vehicle I would want to be assured those individuals were adequately insured? If there was any doubt I wouldn’t let them.

I would personally always shy away from cadets transporting other cadets.

But if you are getting VA then they probably wouldn’t count it as volunteering, and if getting expenses may well count as business use under their policy terms. Having worked for 7 years in insurance they will jump on any minor infraction to kick out their liability.

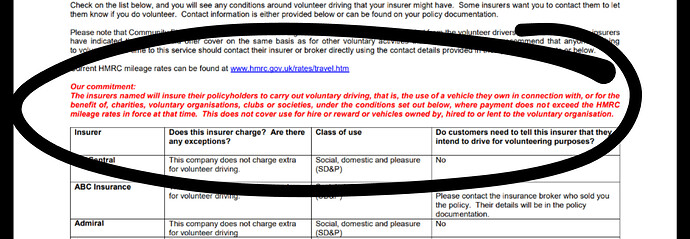

once again i offer the link here

volunteer driving for a volunteer organisation.

shouldn’t matter if it is the RAFAC, the Scouts, Rotary Club, the RBL or church group - volunteer driving is volunteer driving

But different insurers will see it differently where you are receiving VA. I know two of the ones I worked with said if you were being paid it then you were not a volunteer for their purposes

I have spoken to direct line, and explained the situation fully - including VA, HTD, and the fact I used to occasionally move weapons and ammo around for the ATC. They still were not bothered. Their only comment was that I wouldn’t be covered Airside on any RAF airfield, but that seems to be standard exclusion on policies.

Except you don’t claim VA until after the fact (just being eligible doesn’t mean that you are going to claim it).

They can’t say “well you were insured when you drove but when you put that piece of paper in you stopped being insured in the past” and even if they did as long as you don’t put the bit of paper in then you are insured.

Would you apply that argument to someone who works as a Temp and only gets paid if they put in a timesheet afterwards? They are eligible to be paid but they may not claim it so they’re fine?

Personally I wouldn’t risk the possiblity of the insurers voiding the policy and being personally liable, nor risk the criminal sanctions of driving without insurance. I’ve seen the serious damage caused to people using their car for a purpose they thought was covered by their insurance but which wasn’t.

I would advise that each person speaks to their insurer, explains in detail what they are using it for, and get it in writing from them (not from the ABI) that their insurance will not be invalidated.

But it’s your call, and good luck getting support from HQAC if you get it wrong and something happens

which opens up the can of worms of when eligible does it not?

I can drive Cadets to a sports event in my personal car as I cannot claim VA for Sports events.

I can drive Cadets to a morning flying detail as i am only gone 4.5 hours.

I can’t drive Cadets to a AT event as it is a full day trekking and as its 8+ hours and an eligible event, i can claim pay

really??? it is getting that petty

in this example the “temp” is employed - CFAVs are not employed.

the purpose of the journey is to collect a wage, whereas driving Cadets to an event is a volunteering act.

having had “something happen” - nothing actually did when it came to my insurance or HQAC questioning the purpose of the journey or indeed the status of my insurance.

and this opens the door to “hire or reward” - is VA a “reward”?

And that’s great for your insurer not caring. As I said above, some companies treat it as business use. They couldn’t give a rat’s ■■■■ whether you are an employee, a worker, self employed or any other form of status (and we get far too hung up on this ‘employee’ label here), they see it as business use if it’s something you are being paid more than HMRC rate of expenses for.

(But on that subject, most temp workers are not employees. They may be a worker, or self employed. Some are considered employees of the agency, but not all of them)

Nine times out of 10 you’ll get away with it, especially if you say you were volunteering and make no mention of the pay aspect. If you want to risk that tenth time fine, up to you.

On the ‘petty’ front, yes, insurers can be that petty. I dealt with an accident where the individual was insured for social, domestic, pleasure and commuting. One day the boss asked them to make a slight detour on the way home from work, no more than 5 mins each way detour, to drop stock off at a different store. They caused a crash on the way back, seriously injuring someone. The insurer deemed the journey to be business use rather than commuting and the court upheld it. They then paid out to the injured party as required and went after their insured to indemnify them. I had the unpleasant task of taking his house off him, leaving him and his young family homeless. So yes, they can be petty if you get get found out to be using it not for the insured purpose. (That particular case was the reason I left the industry, but there were plenty of less severe cases)

All I am saying is speak to your insurer, tell them the details and check. We are all grown adults and meant to be preparing kids for the real world, let’s just not assume things when it’s easy to check.

Anyway, that’s us give round and round in circles now so I’m out.

So. If you’re a cadet or member of staff and are asked to drive cadets to or from an RAFAC activity it doesn’t matter if you’re employed or not, claiming VA/ mileage or not. You’ve still been asked to do a ‘job of work’ for RAFAC and your insurer may stipulate you need business cover on your insurance policy.

It’s up to the driver and whoever has asked for the job of work to be done to ensure that the correct insurance is in place.

Or if all ACO ‘volunteers’ say nope not doing it in my vehicle, get the organisation to hire transport. It did when I was a cadet, all had to meet at a city centre location, how you got there was your business.

By coincidence, my new policy popped in to my Inbox this morning and it contains an explicit “Voluntary use” clause… “Voluntary use is allowed by persons… subject to their being no payment and/or income received other than expenses to cover running costs e.g. fuel allowances.”

There is also a new clause in the business use section that restricts me to driving to a single place of work and not visiting different sites or offices and not making any business visits on the way to/from work. Fortunately “business visits” is not defined, so that’s one for the legal eagles; but as the man in the street, I’d argue that stopping to pick up a passengers on my way to my “place of work” is not a business visit.

No, it is not a ‘job of work’ for cadets as the cadets are the users/customers of the service, not the providers (CFAVs). I can’t imagine any insurance company classifying it as business use. There is no contract or even a volunteer agreement in place. It might vaguely fall into “volunteering” mentioned above but even that is stretching it somewhat and I have my doubts.

HQAC / MoD need to really get to grips with the demands placed on CFAV. Make too much of this and it only ends one way.

Thought I would have a look at one of main competitors in the youth volunteering sphere.

Using your own car for Scout activities

Motor insurance for transporting Scouts to and from events in your own vehicle is not covered by The Scout Association’s policies.

Under United Kingdom law, the driver of a motor vehicle must hold a suitable third party insurance (including indemnity to passengers) and the minimum levels of cover have to be provided by any motor insurer. As this is a statutory requirement, The Scout Association does not provide any cover to individuals in respect of their liability as car drivers as this would be a pointless duplication of cover. Therefore you will need to check with your own motor insurers to see if this is covered under your policy.

Scouting is considered by the majority of insurers to be a social, domestic and pleasure activity, therefore transporting Scouts is judged to be no different from transporting your child’s friends home from a birthday party or similar event.

The Scout Assocaitions’s personal accident and medical expenses policy will still cover members whilst being transported to and from Scouting activities.

It would seem that the Scouting Organisation is ahead of the game, as it seems they have asked insurers where their adult volunteers stand and it would appear Scouting is regarded as SDP. Pity one of the shineys at HQAC can’t get their finger out and do the same for us. But that would be pro and not inline with the dictatorial approach so beloved of our Ivory Towers.