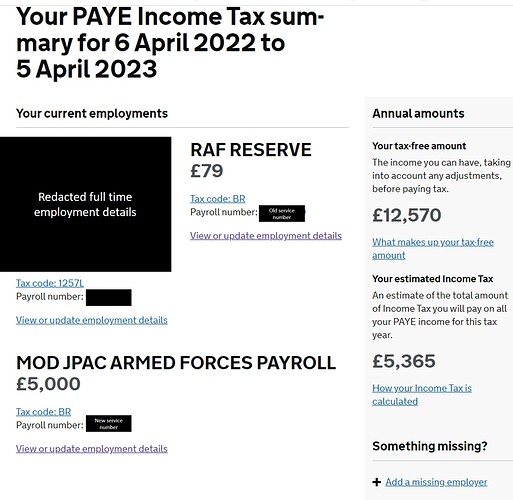

That’s what caused me to get stuck into it… It seems that one can’t really have ‘no’ tax code when they consider RAFAC income to be ‘employment’. My PAYE personal allowance appears to have in fact been on my VA for the past several years. That works great for me, because I don’t earn enough from VA to have to pay tax on it, and my self-employed income and tax liability is all worked out through self-assessment.

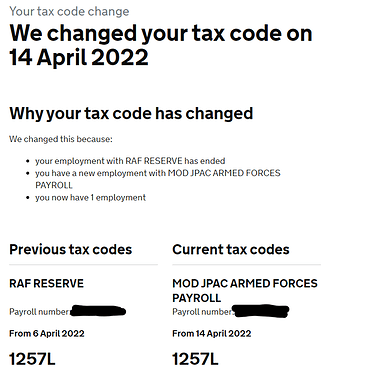

Following the change, my new JPA tax code is still 1257L. I guess you’d want the same set-up.

Will be interesting to see if HQAC will top up take-home salaries if this affects an individual’s overall take-home income.

![]()

![]()

![]()

![]()

![]()

I am guessing people are seeing a similar picture to this when using the Government Gateway?

Seems as mine remains BR i am unaffected and soon RAF Reserve will disappear based on comments above…right?

Ssshhh. Don’t tell them you are RAF Reserve!

Seems someone didn’t update the details when the CFC came in…

Shhhhh dont mention we get taxed like a JOB not a hobby.

It’s INCOME Tax on INCOME from our hobby.

Don’t complain too loudly it can always be turned off

Its Volunteer Allowance though… innit…

Not income!

![]()

![]()

![]()

![]()

![]()

![]()

Yeah, so all your personal allowance is on your full time employment, has made me laugh that HMRC can take your ‘RAF Reserve’ estimate/actual of £79 and get a estimated figure of £5000 for JPA

Maybe they’re going to introduce the training bonus ![]()

It’s called a jubilee medal and as a nice bonus we’re going to be taxed on the value of it.

Sorry what?

Mine’s unchanged from 1281L, Why do I get an extra £24? or £240?

Have you perhaps overpaid tax in a previous period?

That’s a pure guess… I have little idea how the behind-the-scenes HMRC stuff actually works.

Are you claiming the WFH or uniform care tax relief? That would be about the right amount I think.

That could be a good shout, especially if you were claiming it before covid as even though they increased the allowance if you were already claiming WFH they left at the old amount and didn’t increase it automatically

I claim WFH for my other job, partially. Not for this ‘job’

The move to JPA seems to have been accompanied by a reduction in daily VA rate… Interesting.

Anyone else found this?

WO rate seems to have dropped to £74.80 according to MyPay.

The allowance rates document, updated Jan 22 says £79.09. So I would assume that would be correct?

Yes, it has been £79.09 for a couple of years and that’s what I’ve received previously.

Now MyPAY is showing £74.80.