Insurers don’t make money the first year. They rely on people renewing even if it’s more expensive, either because it’s easier or they drop the ball and leave it to the last minute

Admiral put up our “multi” policy (4 cars in family + house building insurance + house contents insurance) by a significant amount (no claims in the year - or even previous few years). As the quote wasn’t broken down into the different categories, I called them & asked for a breakdown - varying percentage increases - the largest one was associated with the building insurance.

An added complication, my wife had recently been made redundant, so that added an increase. However, due to the Covid19 situation, this was one area that they waived.

Anyway, after about 30 mins of to-ing & fro-ing, the overall price achieved was less than last year’s total!!

Always, ALWAYS call to negotiate on prices. Check against the comparison websites to get some idea of other prices (ensuring similar factors / cover) & use them as ammunition against your current provider.

Oh, I did! They couldn’t get it any lower than my renewal quote. Last year, my quote as a new customer was cheaper than the renewal quote, so they matched it. Directline won’t price match competitors tho

I had a car insurance renewal that was +100 on previous. Went on the comparison sites and my company was third, but still a cheaper price than my renewal. Called them and although I stupidly told them what the cheapest price was, they went beyond that to like 50cheaper, beating their Web price by 100 and renewal by about 150.

They also added no claims protection.

Previous years my company has been cheapest on the comparison sites and they’ve (for whatever reason) not matched it for renewal, but cancelled my policy and then added me as a “returning customer” to get the Web price.

I thought this sort of thing was supposed to be getting stamped out…

Haven’t heard of anything. It took a long time for the energy companies to be forced to change their methodology - now they have to include alternative tariffs when renewal comes up.

There are too many people who just let things auto-renew & according to BBC’s Watchdog, pay far too much than they should.

If you do shop around for your car insurance, don’t leave it until the last minute, this article suggests that being an “organised” person = lesser risk. For the last few years, I’ve always set an e-reminder on my calendar so I can fit in a couple of hrs of price checking well in advance of renewal date (everything - cars & house stuff - renews on the same date).

“It’s all based around risk – buying it three weeks before you need it suggests you’re more careful and organised, while leaving it to the last minute means you’re seen as higher risk, with some insurers telling us they’ve seen a direct link between drivers who leave sorting their insurance to the last moment and a higher number of claims.”

Always important to be aware of what’s covered. My mum was a school business manager. One of her secretaries took the post to the postbox on the way home from work and had an accident. When insurance asked where she was going she mentioned taking the school post to the post box - no pay-out, she was using the car for Business purposes even though it was on her way home.

Goodness me. Sometimes the least said the better!

So trying to get everything sorted and it seems VA could throw a spanner in the works. I know all the arguments about it being an allowance and uniformed staff in receipt of VA are not classed as employees.

But, as tax and NI are paid on VA would this be classed as payment or not?

If classed as payment then every insurance company I have spoken to, including those like Direct Line who include class 1 business use at no extra cost , are saying that the volunteering isn’t covered as standard and putting the costs up

It entirely depends on the insurance’s underwriting policy. I know the last time I spoke to mine they said if I am claiming fuel costs back and nothing else, then it is included in the policy. Anything else above fuel costs needed business (although this barely increased the cost at all!)

This is the hurdle I got to.

Every insurance company I’ve said is because VA gets paid from the time you leave your home then you are getting rewarded to drive to the event… Hence need business which pushes my premiums up

Even the ones who say they give class one business at no charge bump the price.

So I could drive a couple of thousand miles a year getting paid by an employer for their business/generating profits for my own business and its fine but if I am getting ‘paid’ by RAFAC then I need more cover 🤷

I get that but even those that include business cover in their quotes say it’s doesn’t cover RAFAC activity when getting ‘paid’

I did have a notification only ‘claim’ around 18 months ago which isn’t helping prices ![]()

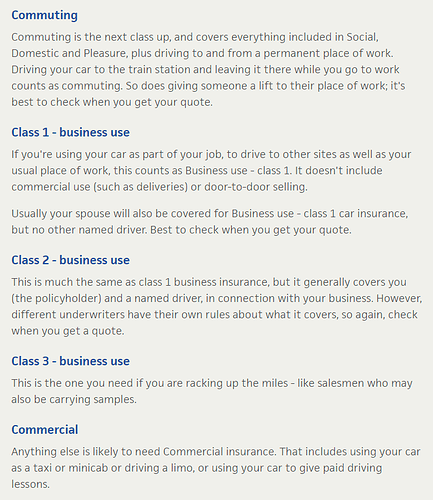

Normally the ‘Commuting’ bit is defined by traveling from home to a permeant place of business. This means if you work all over the place you need business cover, even if you aren’t being paid for the driving bit. I think this is where the RAFAC bit come in as it’s not commuting per-se.

RE why RAFAC needs more than class one business cover, I don’t know. I thought there were essentially 3 types. Business, deliveries and Taxies. EDIT: This is wrong.

I may be talking rubbish on that last bit though!

Yeah, the problem I am finding is they are saying class 1 business doesn’t cover it because I could be ‘paid’ by RAFAC

But you are also paid by your employer when you drive to visit customers, I’m struggling to understand why the VA element changes the type of business cover vs needing it or not

Why I don’t use my car for cadet purposes other than "commuting"to the school to then get in the school minibus

Yep, this. I think class 1 should be fine.

Me too!

So 2 companies include class 1 business cover in there quotes and say volunteer driving is covered without additional cost according to the ABI document shared in an earlier post by goodegg but when speaking to them on the phone they are saying VA classes as payment so that pushes the price up for some reason but can’t explain it to me either ![]()

I think the simple answer is that insurance companies will just use any excuse to get more money from you. Same with the no-fault claims putting prices up. Had a woman smash into the back of my car. I stopped because the car in front of me did, she wasn’t paying enough attention so smashed into me at decent speed, needing the rear of my car to be replaced. She admitted liability, no arguments at all. Yet now my insurance for this year was about 35% more expensive.

Same idea with the VA excuse. Just a reason to get more money out of you?